The government will pass it’s amended stage 3 tax cuts following announcements earlier today by Peter Dutton.

The amended cuts retain two tax brackets between $45k and an upper tier which is now $190k. The original cuts intended to have only one bracket with earnings between $45k and $200k taxed at 32%. The effect of the changes is to reduce the tax benefit to those earning more than $135k.

There is no allowance for the indexing or regular increasing of the tax bracket amounts, meaning the government will continue to reap more tax dollars from individuals over time, as earnings rise with inflation and push more and more into higher tax brackets.

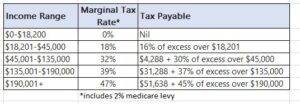

The new tax rates will come into effect from 1 July 2024 and are summarised in the table further below. The rates below include the medicare levy of 2%. Note that those earning less than $32,500 may pay a reduced medicare levy.

If you are paying staff through an electronic payroll system, the tax rate changes will be calculated automatically. Superannuation will remain at 11% of gross wages.