Do you want to manage Profit First transfers each week but are coming up with hiccups with the income account?

It’s easy for expenses to inadvertently leak out of the income account, with things like annual direct debits coming out as a surprise.

When this happens, it can leave you feeling like the system won’t work, but don’t throw out the baby with the bathwater. Unexpected events will always happen and from experience, here’s a way you can still make your Profit First transfers work;

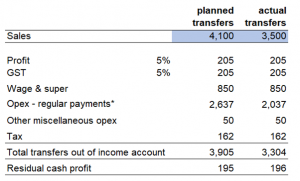

- set out your planned profit first transfers in a column in a spreadsheet,

- in the next column, add the actual income amount and add up all the unexpected spending from the income account, and

- for the actual transfers, subtract the extra spending you have already made from the opex transfer amount and make the other transfers as normal. ie profit, gst, owner’s comp, tax as normal.

Here’s an example of what this looks like. $4,100 has been received as income, however, $600 of expenses have inadvertently come out of the income account during the week. The adjustments to be made are a reduction of the transfer to the opex account of $600. The amounts for profit, GST, wages, other opex and tax are as for the full amount of $4,100 (note the GST percentage of 5% reflects the average net percentage of GST paid each quarter).

If you set up a table like this, you will always cover yourself for profit, taxes and expenses. If you want to make a start, set up a table like the one above and if you want a hand, let me know (book a time here for an initial call). Also check out the Profit First page here. You’ll be in charge of Profit First transfers in no time regardless of unexpected spending from the income account.